Forstater v CGD [2022]

WE WON! – the judgement

Documents

This page will contain information about the case, and will be added to as it goes along:

- NEW: Livetweets

- Playlist (Spotify)

- Particulars of the claim (May 2019)

- Grounds of resistance (May 2019)

- NEW: CLAIMANT’S OPENING SUBMISSIONS (March 2022) A mini bundle

- NEW: RESPONDENT’s OPENING STATEMENT (March 2022)

- NEW: CLAIMANTS WITNESS STATEMENT (March 2022) (pdf without evidence)

- NEW: CLAIMANTS WITNESS STATEMENT and evidence minbundle (large file)

- NEW: Luke Easley Witness Statement

- NEW: Amanda Glassman Witness Statement

- NEW: Mark Plant Witness Statement

- NEW: Masood Ahmed Witness Statement

- NEW: Respondents closing submission

- NEW: Claimants closing submission

- NEW: Bundle (large download)

| IMPORTANT UPDATE The first day of the tribunal was taken up by a late application by CGD for a Restricted Reporting Order. The order that was granted by the Tribunal was that the names (and email addresses) of the four individuals who made complaints about me internally should not be published during the course of the hearing, and up to the time when the judgment is handed down (the Tribunal may then decide to continue or change the Order). The reason given for this is that it undermines their reasonable expectation of privacy at the time that they made these complaints internally. Their names and email addresses will be redacted from all public versions of the bundle, witness statements and evidence that are made available during the hearing. However their job titles and roles will not be redacted, and may be reported, as they are relevant to the narrative. Their names may be used by the witnesses in giving live evidence and the lawyers in cross examination, but where this happens these should not be reported in live tweets etc. Therefore if you obtain a log-in and watch the tribunal you will be informed by the Clerk to the Tribunal which names you must not publish or report. If from following the evidence and/or live tweets etc you work out the names of any of the four people covered by the Reporting Restrictions you must not publish this information. IT IS A SUMMARY CRIMINAL OFFENCE TO PUBLISH THIS INFORMATION – PUNISHABLE BY A FINE OF UP TO £5,000 |

My name is Maya Forstater. I lost my job for speaking up about women’s rights and gender self-ID. I am taking took my ex-employer, the Center for Global Development, to employment tribunal for discrimination on the basis of belief.

It will be online only. To obtain a login to watch email CentralLondonETpublicaccess@justice.gov.uk . Read the spectators guide for more details.

I

What is the case all about?

In September 2018, when the UK government was consulting on whether to reform the Gender Recognition Act to gender self-ID I started to tweet about the subject. I was working at the European office of a US headquartered organisation; the Center for Global Development (CGD).

I was subject to an investigation. I did not have a chance to see the complaints, and I lost my job.

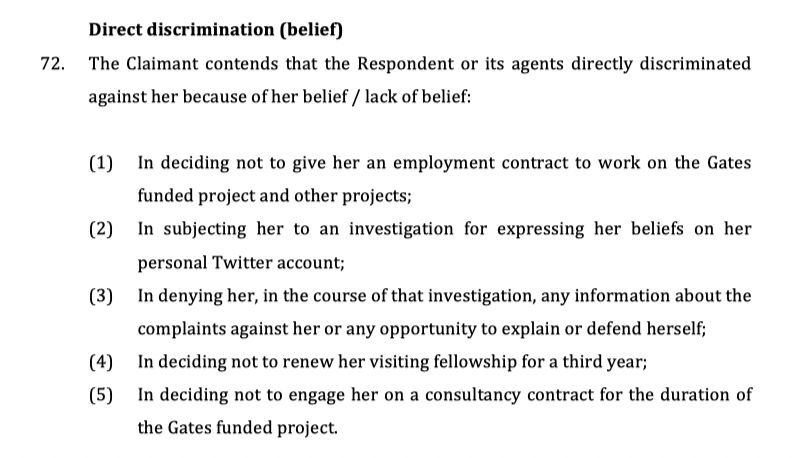

My claim is for belief discrimination, harassment and victimisation.

You can read the long story about what happened in 2018 and early 2019 when I lost my job.

There is also a Wikipedia page for the case.

In 2019 I lost the first stage of the tribunal which was to establish whether my belief that sex is real, immutable and important is protected as a philosophical belief under the Equality Act 2010.

In 2020 I won in the Employment Appeal Tribunal when this judgment was overturned and belief was found to be “worthy of respect in a democratic society”

The next stage is to go back to the Employment Tribunal for the facts of the case to be heard. This starts on 7 March 2022.

(There are previous pages for the EAT appeal and one from the first hearing)

Press inquiries

For photos of Maya: http://www.hiyamaya.net/photographs